Since May 2003, Virgin Money Australia has shaken up the financial services industry by fighting to keep the big banks honest with home loans, super and credit cards to provide value for money, innovation and terrific customer service.

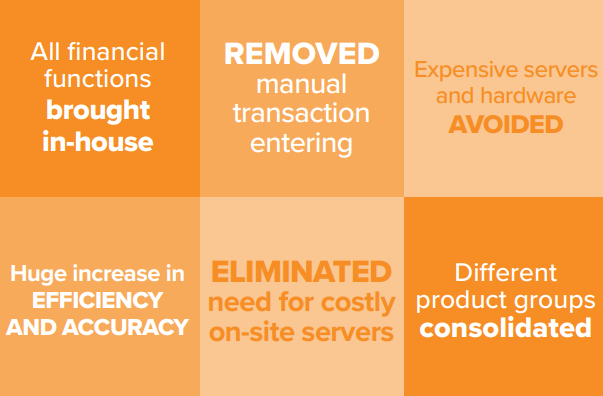

They wanted to bring their outsourced accounting function back in-house, as manual transaction entering was slowing down their response times. Virgin Money also sought more robust reporting and increased efficiency across financials.

NetSuite was chosen and Virgin Money made significant savings by eliminating the need for expensive servers and hardware. They were able to streamline processes for bank reconciliation, expense payment and purchase orders, and passed cost savings along to customers.

The company was also able to integrate subsidiaries, users, and new product lines without incurring large capital expense costs. Most internal processes are now automated, simplified and more accurate, and importantly, NetSuite’s scalability provides Virgin Money with the necessary room to grow.

“NetSuite OneWorld has the multi-company capabilities and Web-based nature that make it ideal for our business requirements. We’re far more efficient than we were before.”

Virgin Money Australia